Outbreak of coronavirus or Covid-19 has resulted in crippling stock markets world over.

After hitting all time 2weeks ago, S&P500 has crashed over 10% in less than two weeks and the results are not much different elsewhere in the global markets.

Not All Asset Classes Are Down

Though there are several ways one can slice and dice asset classes, for this article I will assume four major asset classes and exclude cash and currencies:

- Bonds US 30 years

- Gold using Gold Futures

- Stock Markets such as Dow Industrial, Dow Transport, S&P500, Nasdaq and Russell 2000

- Commodities such as Crude oil

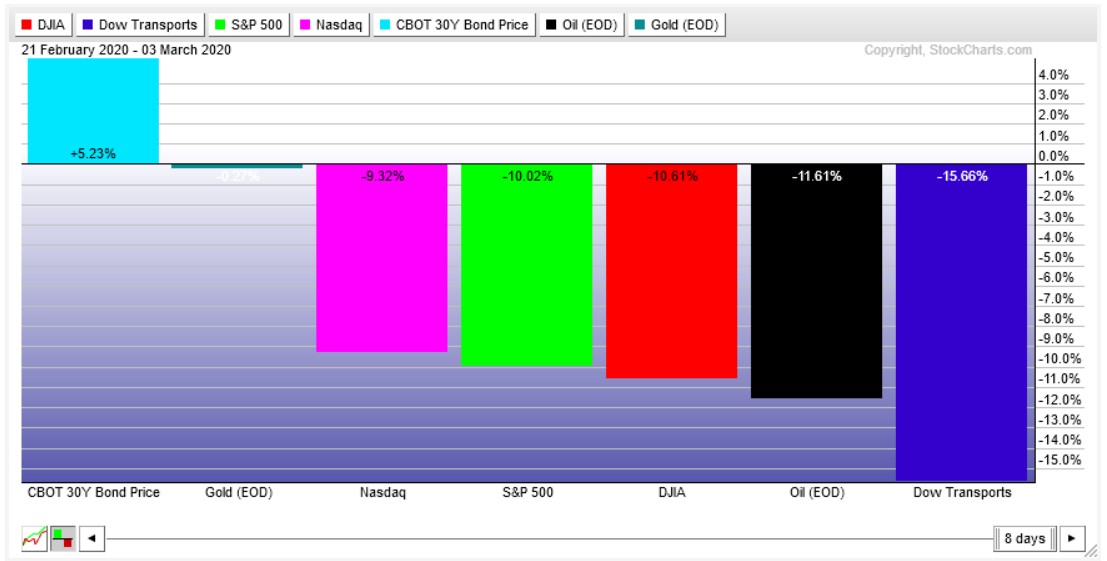

Since the crash began on 21st Feb, safe heavens assets like US Bonds have outperformed broader stock markets by roughly 15-16%.

US 30 Years Bonds have rallied +5.23% while S&P500 down -10%.

Surprisingly, Gold which acts has a safe heaven during uncertain times, didn't deliver great results either during these 8days period.However, ever since coronavirus outbreak was spreading from early Feb, gold has been rallying.

Recent drop in Gold Prices can partially be attributed to payments to cover margin calls triggered by steep stock market losses.

Yesterday, US Federal reserve announced a surprised 50bps interest rate cut.

Generally, rate cuts of this size sparks a huge rally.

Soon after interest rate cut announced, S&P500 rallied 70+points within 3mins window!! S&P rallied to intraday high 3136, and then it pulled sharply to drop almost 150point to 2977 before closing at 3003. A wild swing day!

Here is market heat map as generated by by finviz.

Global Stock Markets Are Down

As china is starting to recover the aftermath of Wuhan virus aka covid-19, all other major stock market indices are down led by German DAX which is down -13%!!

From Bombay stock exchange to US S&P500, all indices pulled back sharply. No major market index is spared.

Intraday index price range has expanded significantly.

Such a sudden crash and expectations of global recession led US Fed to announce surprise 50bps cut in interest rates.

CBOE Volatility Index VIX, also known as the Fear Index, is inversely correlated to S&P500. Recent stock market crash led to greater than +250% rise in VIX!

Is it a Market Crisis or an Opportunity

The market does offer a few choices and it all begins with your outlook.

Crisis or opportunity are the two side of the same coin.

For long term stock investors, if you have been longing to enter into raging bull market but were waiting for better prices, current market conditions are offering you better price than what it was 2 weeks ago.

As implied volatility is very high, Options premiums have sky rocketed. You can sell Cash Secured Put Options to acquire shares you desire at discounted prices. If your options are exercised you get the stocks you desire at your prices. If however, your options are not exercised , you will be able to keep inflated premiums thus delivering you much higher yield vs normal times.

Selling cash secured puts, however, requires large capital base to cover cash requirements when short put options are exercised.

Another way to benefit from elevated options premium and bullish move is to open Bull Put Credit spreads, a type of vertical spread.

A Vertical spread is an option spread strategy whereby an option trader purchases a certain number of options and simultaneously sells an equal number of options of the same class, same underlying security, same expiration date, but at a different strike price.

I will explain vertical spread in another article.

If however, you are bearish and you think this is just the beginning of a long term crisis, you can hedge or protect portfolio using Put options.

However, do take note that Put Options are now expensive when compared with last 3 months moving average prices.

Why?

Implied volatility has risen significantly driving options premium to record high levels.

Whatever you do, you have to weigh risk and reward for each trade. If you need my help, level a comment below and explain your thoughts as clearly. I will be happy to share my thoughts.

What do you think? Is it a short term crisis or 11 year long bull market has come to an end? Join the conversation by leaving a comment or question below.

Happy Trading.

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.