Why do most traders lose money, even though they have time tested trading system with proven strategies?

A lot of this has to do with how they manage their emotions once they are in a trade. Let's dive deeper to understand what goes on in a trader's mind.

The majority of us have spent a great amount of time searching for the holy grail in trading.

We are attracted by the amazing news in media that so and so has just made a big fortune from the stock markets. We are amazed by their trading results and hope that we could have similar results too.

While a wide majority of the people turn to YouTube and free contents to learn about trading and start investing with real money, many do go through structured and step-by-step education. As the saying goes, knowledge is only potential power and thus equipping with the skills alone doesn’t generate your desired outcome.

Have you ever been in a situation that you learned appropriately from an established educational school but still losing money?

Let us first assume this educational school is established and then have a proven system with time tested strategies and the system is indeed a profitable system.

So, why is it that you are still losing money when applying the time tested trading system?

Why do traders lose money?

First, let me make it clear what do I mean when I say "lose money" or "make money", I’m referring to the overall results instead of individual trade results. In addition, while there are many reasons why a trader may lose money, this post focuses on the scenario where a trader has acquired proper education in trading and has profitable trading systems at hand, yet still loses money.

Sherlock Holmes said, when you have eliminated the impossible, whatever remains, however improbable, must be the truth.

So, if it is not about your knowledge in trading, not about the trading system, than what is it about?

Sorry to point that out, but the answer is You.

Or more specifically, your mind. I wish I had known earlier how important psychology plays a part in trading, but sadly I learnt it the hard way.

What is the psychology of trading?

The psychology of trading is the emotional component of an investor’s decision-making process. It is characterized by the balance between greed and fear.

When greed is taking control, we tend to take more risks and are likely to take aggressive trades.

On the other hand, when fear is in control, we tend to be risk-averse and are likely to stay put with no trades taken or walk away from a position with a small profit or a loss we can bear no more.

So, How do emotions affect a trade?

The Story of Jack

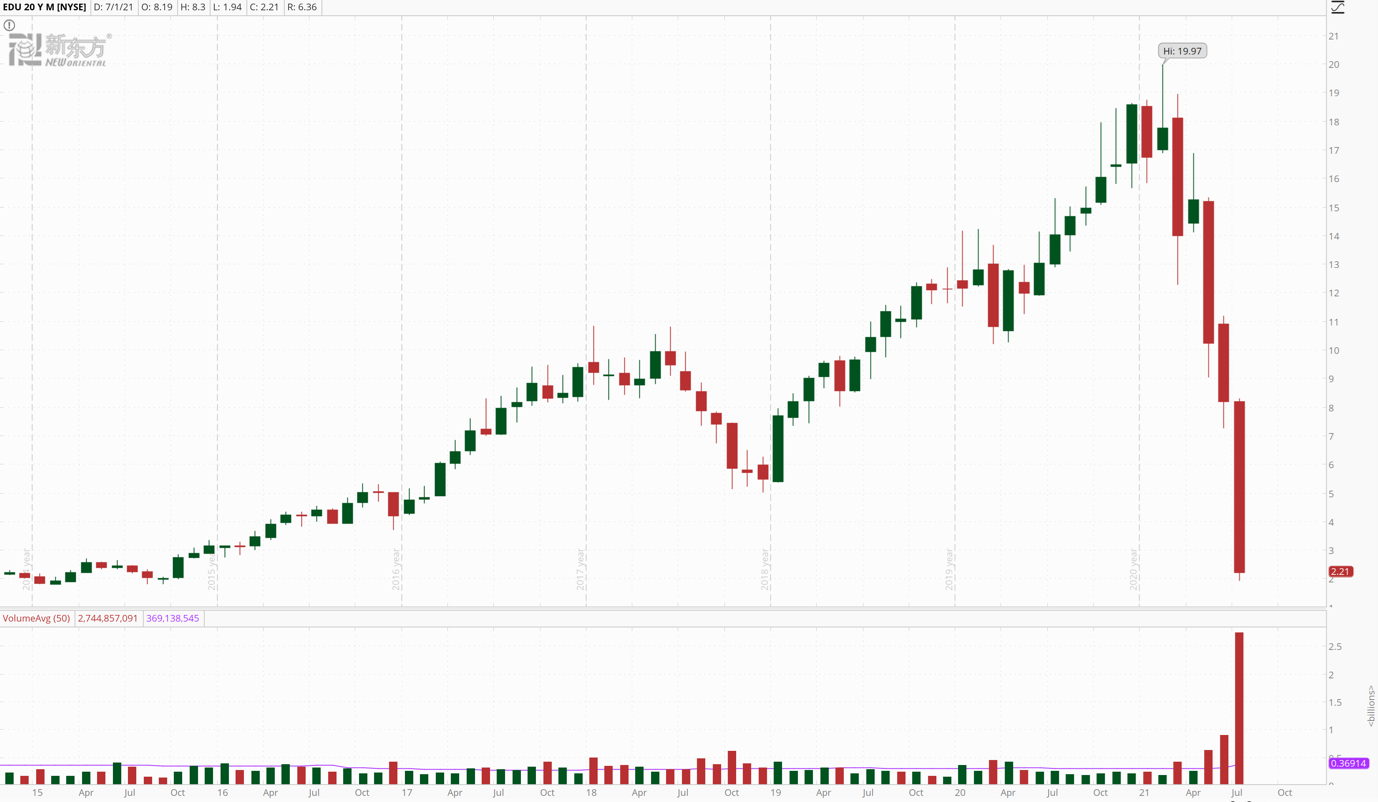

While reading the story of Jack, you may refer to figure 1 for the price action of the stock.

Figure 1: Monthly Chart for New Oriental

Source: ThinkorSwim by TDAmeritrade

Chapter 1 – All is good

Jack had done his homework on stock scanning following a profitable trading system and had identified a good candidate, New Oriental.

When the price was traded at $15 in Mar 2021, he bought 200 shares, because according to the system he can allocate as many as 200 shares and $15 is a good deal.

He followed everything in the system and had checked all boxes.

Chapter 2 – Greed Kicks In

The stock went up as high as $17 in April and Jack regretted that he should have bought more shares. When the stock price of New Oriental pulled back, Jack treated it as an opportunity to add another 200 shares.

In Jack’s mind, when the stock price went back to $17, he would have then made twice the profit as he had doubled the number of shares. His current position was at profit but he was not satisfied with the return and wished it to go higher.

Chapter 3 – Refuses to accept the loss

However, the stock price of New Oriental didn’t look good in May. Not only did jack give back the return, but his position was at a loss.

According to the system, he was supposed to cut loss when shares of New Oriental dropped to $14. However, cutting the loss at $14 would mean realizing a loss of $400.

The pain of cutting loss is too much that Jack decided to hold on to his belief that the stock price will come back up.

"That’s what stocks do”, says, Jack. “Give them enough time, the price will always come back.”

As a result, instead of being a trader of the New Oriental stock, he switched to a long-term investor of the New Oriental stock.

Chapter 4 – The first loss is the best loss

Contrary to Jack’s wish, the stock price of New Oriental went down from $15 to $10.5 in May.

Furthermore, at some point, it was traded at as low as $9.5. Jack’s position was down 30%, close to one-third.

Now the idea of cutting loss at $10 didn’t sound unacceptable at all. In fact, given a chance, Jack would beg for the opportunity to cut the loss at $14.

Sadly, it’s too late and he definitely didn’t want to cut the loss now. He didn’t know what to do except for hoping that the stock price could come back up.

He didn’t open any new positions because he was so emotionally affected by this single trade.

Chapter 5 – Enough is enough

May was a bad month for Jack, and he hoped that June would be better and the stock price of New Oriental would come back up.

Unfortunately, the stock price of New Oriental dropped further down from $10.5 to $8. Jack was holding on to the last thread of hope until July.

In July, the stock price of New Oriental plunged from $8 to $2. It was too much for Jack to handle emotionally. He called it enough, closed the position, and stopped trading.

How to manage the emotions of trading?

It’s easy to learn the skills on how to trade, but it is tough to manage our emotions.

Jack had a good trading system. However, he let his emotion get the best (or worst) of him and he messed around with his trades.

Know yourself

In order to manage your emotion, you have to first be conscientious about yourself.

What are your strength and weakness in trading?

Are you a very jitter trader that’s easily affected by the P/L change or you are a very calm trader?

Are you a very patient trader or someone who has the urge to act on the change on every 1min bar?

It might come as a surprise to you, but the biggest enemy in trading is our own emotions.

Follow the system that fits your personality

One way to keep your emotion in check is to trade only the system that matches your personality.

There are many good systems designed by many wonderful trading experts, but it never means all systems suit you.

For example, if you are an impatient trader, a profitable trading system that requires a lot of patience won’t be the right fit for you.

Have a trading plan

Having a trading plan is essential to a successful trader.

A good trading plan defines the routine check before you get into a trade and sets the trade management rules when you are in a trade.

When you have rules to follow, you have given your emotions less chance to take control.

In doing so, you will less likely fall as a victim to greed or fear.

However, you should design your trading plan in a way that you can follow and have the discipline to follow through with the trading plan.

If you can’t follow your trading plan, it’s just a plan to fail.

Track your trades

You should track all your trades and especially those trades that you broke your plan.

For those trades you broke your plan, what would the results be if you had stuck to your plan?

How would the difference in results affect your P/L in the long run?

This data set is a good reference for you to improve your trading plan and fine-tune the trading system to suit you better.

Bottom-line

Trading is about letting the odds be in your favor in the long run.

When you have an appropriate trading system, good trading plan that you can diligently follow, and a detailed track sheet, there is little room for your emotion to get in your way.

Strong foundation is key so you have good skills, systems. Continuous support is necessary so you can continue to build upon what you know before you start gathering real life experiences.

One such place to start on a very strong footing is our workshop. For the first time, we are running a 4-days Options Bootcamp that is perfectly suited for those who are new to options or have some experience in trading options. It's absolutely free during covid-19 pandemic times.

Please note, even though it is a FREE workshop, Seats are on a first come first serve basis and limited in number due to ZOOM room capacity.

I hope you enjoyed this article. Do share your thoughts or experiences in the comment section below.

Lets start the conversation.

Happy trading.

Get Free Access to The Market Insider's Newsletter:

Want behind-the-scenes stock & options strategies and actionable insights delivered biweekly to your inbox? Join 40,000+ savvy investors and start growing your wealth!

*We send you weekly goodies to help you make more money. Unsubscribe anytime.